luvflyin

Touchdown! Greaser!

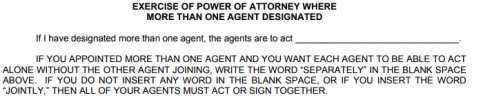

Can two agents be named. Like Tom OR Harry?

Out of curiosity, I looked at the statutory form power of attorney in California.I have no idea of the rules in California but I'm not aware of any states that would prevent that. You may want to think about the best way to word the authority - what if they disagree? The most typical is either acting jointly or one a primary and the other when No. 1 is unable to act.

It’s in Oregon. Here’s the situation. My sister is Agent. If she’s unable/unwilling to act then I become Agent. It goes on to say anyone MAY accept my saying she is unable/unwilling without further inquiry. Problem is it appears no Financial Institution like banks will do it. I wonder if changing ‘may’ to ‘shall’ would work. But I think that a better way might be just drop all that stuff and do the ‘or’ thang.I have no idea of the rules in California but I'm not aware of any states that would prevent that. You may want to think about the best way to word the authority - what if they disagree? The most typical is either acting jointly or one a primary and the other when No. 1 is unable to act.

I knew that was coming. Hey, I see the Hurricanes are doing pretty good in the playoffsHow about a third. Dick?

I guess the bank wants more evidence of “unable or unwilling” that the substitute claiming so.It’s in Oregon. Here’s the situation. My sister is Agent. If she’s unable/unwilling to act then I become Agent. It goes on to say anyone MAY accept my saying she is unable/unwilling without further inquiry. Problem is it appears no Financial Institution like banks will do it. I wonder if changing ‘may’ to ‘shall’ would work. But I think that a better way might be just drop all that stuff and do the ‘or’ thang.

Yeah. If I was Bank I would to. Anyway, as far as you know, naming two Agents with ‘or’ is a legal thing to do, correct?I guess the bank wants more evidence of “unable or unwilling” that the substitute claiming so.

Specify that the have the power to act separately. And Bob's your uncle.Yeah. If I was Bank I would to. Anyway, as far as you know, naming two Agents with ‘or’ is a legal thing to do, correct?

It’s in Oregon. Here’s the situation. My sister is Agent. If she’s unable/unwilling to act then I become Agent. It goes on to say anyone MAY accept my saying she is unable/unwilling without further inquiry. Problem is it appears no Financial Institution like banks will do it. I wonder if changing ‘may’ to ‘shall’ would work. But I think that a better way might be just drop all that stuff and do the ‘or’ thang.

I do not know whether or not there are specific rules in Oregon to cover the question.Yeah. If I was Bank I would to. Anyway, as far as you know, naming two Agents with ‘or’ is a legal thing to do, correct?

The one we have is everything. Banking, buy and sell property, stocks, medical care It's about 3 pages longMost banks will not accpet a general POA anyways. They’ll want a specific POA for banking or financial transaction purposes.

Yeah. I suppose that could be added in. But the word 'or' should have that covered.Specify that the have the power to act separately. And Bob's your uncle.

Called a contingent agent.It’s in Oregon. Here’s the situation. My sister is Agent. If she’s unable/unwilling to act then I become Agent. It goes on to say anyone MAY accept my saying she is unable/unwilling without further inquiry. Problem is it appears no Financial Institution like banks will do it. I wonder if changing ‘may’ to ‘shall’ would work. But I think that a better way might be just drop all that stuff and do the ‘or’ thang.

The best answer is to speak with an attorney licensed in Oregon. Any decent estates attorney would be able to answer this quickly.Yeah. I suppose that could be added in. But the word 'or' should have that covered.